Picture this: you’re walking down the bustling streets of Berlin, past storied buildings where history whispers, and you’re struck by a palpable energy that’s distinctly modern.

This isn’t just the heart of German culture; it’s the throbbing pulse of Germany’s tech boom, a land where startups aren’t just sprouting—they’re scaling to heights as German unicorns.

Investors and business enthusiasts, take note. Because here lies a phenomenon shaping the economic narrative of an entire nation.

Embrace this passage, as we unveil the veiled territory where innovation converges with investment rounds to breed billion-dollar behemoths.

By journey’s end, you’ll grasp the essence of Germany’s startup valuation landscape.

You’ll be conversant with entities like Rocket Internet and N26, understand the impact of venture capital funding, and why Berlin’s startup ecosystem has become a magnetic center for high-growth startups.

Prepare to unravel the stories of these elusive titans, dig into their IPOs, and explore their secrets to mind-bending valuations within the European unicorns circuit. Let’s dive into the realm of the rare and the revolutionary.

Germany’s leading unicorns

Personio

Personio specializes in smart up/small-biz software for cloud-based HR management. It took it about five years to reach $1 billion in value and to become a so-called unicorn. Founders are Hanno Renner, Roman Schumacher, Arseniy Vershinin and Ignaz Forstmeier. They created the company in 2015.

The first big raise happened in 2021 when the company raised $270 million in investments. Later that same year, the Munich-based startup got a Meritech investment worth even $175 million. 2022 brought it an additional $200 million, so its total value rose to an incredible $8.5 billion.

N26

N26 is another praised representative among the German unicorns. It is, in fact, a leader among digital banking platforms in the European Union. Using it, you can manage all banking activities on the go, keep expenses under control, and even save money online. You can do all of this from the comfort of your mobile device, and start using their services before you even have a physical card.

Every user gets to create their primary and debit account for free. Premium users, on the other hand, can make use of overdraft and investment products.

Following the latest investment rounds, the start-up reached $1.8 billion in value. Thanks to it, it became one of Europe’s most important and stable Fintech.

Celonis

Celonis belongs to the family of enterprise software solutions. It specializes in execution management and process mining. The highlights are task mining, real-time data intake, action flow management, and much more. It is one of the most perfected German unicorns in terms of usability and ERP.

Accel and 83North were among the first funds to invest in the company. They pulled in more than 50 million US dollars in the unicorn startup during 2018. The company was only around since 2011, but it seemed to understand how operational processes can be improved. With an injection of $27.5 million in the year to follow, Celonis became the first of all german unicorns to have reached $1 billion. Nowadays, its valuation is an unbelievable $11 billion.

Gorillas

Gorillas are also a very young company, but it already operates in more than 60 cities worldwide. Other than cloud-based HR management or mobile banking, this startup focuses on a very simple line of business delivery.

Lightspeed Venture partners recognized lots of potential in on-demand household and grocery delivery. Customer order online from their favorite merchants, and Gorillas brings their purchases to their doors.

The 2000 Series A fundraising brought Gorillas a $44 million investment. Series B followed in 2021 with even $290 million plus. As expected, Series C funded with over $1 billion at the end of 2021. No wonder Gorillas is the fastest-growing startup in Germany. It got where it is in only 9 months!

Contentful

How about a headless content management system? This Berlin company offers an interface to connect apps, websites, devices, and channels. It has been around since 2013, and it also offers a beta version of the software.

The first time investors paid serious attention to it is after New York Times reported its incredible success. CB Insights was predicting in 2019 that Contentful is on the way to becoming a powerful German unicorn. They also stated that it will be worth more than a billion dollars.

As it turns out, they were right. Contentful even launched its third-party store and native apps that can run on the platform. What is more, the APIs are publicly available, so more and more apps are connected to them.

Flink

With Flink, you can forget about traditional grocery shopping. The unicorn startup delivers more than 2,400 different products to your doorstep and does so within minutes. Its potential was first recognized by the American delivery service DoorDash. They invested $70 million in the flash supermarket.

Next to invest were Bond (majority owner of Uber and Airbnb), Prosus, and Mubdala (Abu Dhabi sovereign wealth fund). In total, the unicorn startup got a boost of $240 million in a single year, raising its valuation to $2.7 billion.

Trade Republic

Thanks to Trade Republic, millions of Europeans get secure and free access to financial markets. The startup was created in 2015 by Thomas Pischke, Christian Hecker, and Marco Cancellieri.

The first major investors in the startup were Thrive Capital, TVC, and Sequoia. Their investments amount to a remarkable $900 million. As a result, Trade Republic is now worth $5 billion.

Tier Mobility

Tier Mobility, on the other hand, focuses on micro-mobility. It allows customers to find ride-sharing possibilities. Next to it, it also lets you rent e-scooters, bicycles, and mopeds. Currently, it operates in even 60 German cities.

At the same time, Tier Mobility is the first micro-mobility company in the world that is completely climate-neutral. They help reduce harmful emissions not only in transport but also production.

Solarisbank

Solaris is another one of these German unicorns. Mark Wenthin and Andreas Bittner created the startup in 2015, but it took them a whole year to obtain a banking license. The startup attracted lots of venture capital. It came mostly thanks to their strategic MasterCard partnership.

Nowadays, they offer all standard financial modules. That being said, they are among the companies valued for their innovation policy.

WeFox

How about digital insurance? Wefox was the first company to prove this is possible. They combine both human expertise and insurance technology to provide impeccable service. Thanks to them, thousands of users track and manage their insurance fully digitally.

The startup belongs to Wefox Group, an insurance firm based in Berlin. Series B fundraising brought the company more than $110 million, which is more than anything anyone received at that funding round. This is only one of the records Wefox broke- They are continuing to grow as we speak.

Scalable Capital

The most important year for Scalable Capital was 2021. They received an incredible $180 million from Chinese investor Tencent. The startup acts as a digital asset manager, currently valued at $1.4 billion.

It was founded by Erik Podzuweit, Stefan Mittnik, Adam French, Florian Prucker, and Patrick Pöschl in 2014. So far, the FinTech startup has gathered over $320 million worth of investment.

Sennder

Sennder connects enterprise shippers with mid-sized trucking companies. The purpose is simple – their return journeys are no longer empty!

It didn’t take a while for this company to reach a net worth of $1 billion. Thanks to it, it is one of the most appreciated tech startups in Europe and the world.

Agile Robots

As indicated by its name, Agile Robots develops intelligent robot systems. It also provides all sorts of app development services.

FlixMobility

There is little chance you’ve been to Europe, and haven’t seen a FlixMobility transportation operator. The company doesn’t only operate in transport, but it also offers travel tips and holiday packages.

The German operator managed to raise over 500 million euros ($561) in Germany’s key funding round. There is hardly any startup up there that got such backup during its expansion.

Forto

Freight forwarding customers know Forto pretty well. The platform specializes in the delivery of logistics software, and it improves the supply chain of its customer.

It is known for its efforts for sustainability and high performance. Appreciated is also the integration with multiple solutions in the same industry.

Omio

Omio has been on the market since 2013. In essence, it is a travel app you can use to find or book bus rides, train rides, and flights at the same time.

Its headquarters are in Berlin. With a total funding round of €134.7 million, the online platform surpassed its expectations. It now has a huge office in the capital with more than 350 international employees.

Infarm

Infarm might have attracted the biggest investor interest of all startups on this list. It got support from Atomico, Hanaco, Bonnier, Lightrock, and even the Qatar Investment Authority. Born and established in Berlin, the intelligent modular farming system is now more than $1 billion worth.

Founders are brothers Erez and Guy Galonska, and Osnat Michaeli.

Enpal

Enpal is the place to go for photovoltaic leasing. The company ensures homeowners get solar power systems without paying upfront for them.

GetYourGuide

Hard to imagine, but ever since 2009 people use the online platform GetYourGuide’s to book and manage their travels.

If you check now, there are 50K + top reviews and experiences from satisfied customers. GetYourGuides offers insights on more than 7,500 destinations.

Its first large investment flow was $484 million, which is already more than a startup can imagine. The amount was boosted by SoftBank Vision Fund which entrusted it with a further $100 million. At the moment, the startup is worth $650 million.

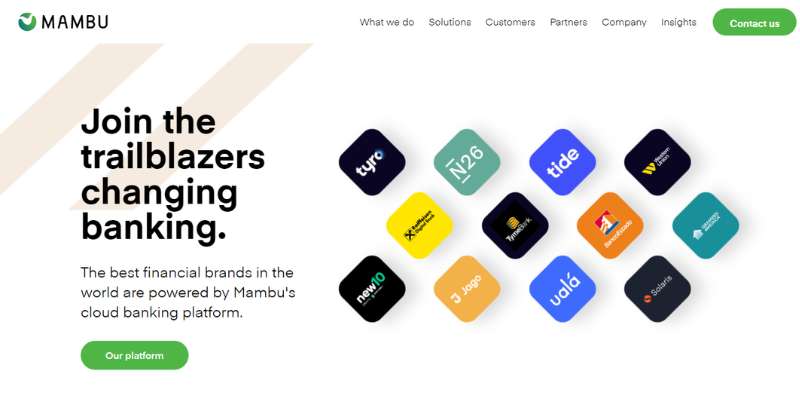

Mambu

Last but not least, Mambu has a valuation of $4.9 billion. FinTech’s most notable funding was in 2021 when they got $235 million.

The Berlin-based SaaS platform helps provide financial services. It also has established a strategic partnership with N26.

After the last investment round, the company attracted the attention of international investors.

FAQ On German Unicorns

What defines a German unicorn company?

A German unicorn is akin to spotting a mythical creature in the Harz Mountains — rare but real.

It’s a privately held startup, birthed in the land of beer and bratwurst, valued at over a cool billion dollars. And yeah, no public stocks — yet.

How many German unicorns are there?

Picture a room full of visionaries; that’s the scene. As of my last count, the tally was hovering over two dozen.

Seems Germany’s well on its way to building an entire mythical forest of these heavy-hitters, especially around tech hubs like Berlin.

Which sectors do German unicorns typically operate in?

It’s a smorgasbord, really. Key players strut across various stages — FinTech, e-commerce, software, and biotech.

You’ve got the likes of N26 revolutionizing banking, while BioNTech commands the biotech stage. They’re weaving a diverse tapestry of innovation.

What’s the biggest German unicorn?

Now, these are heavyweight champs. Auto1 Group flung the doors wide open with a valuation that’s something to gawk at — think the billions with a ‘b’.

They turned selling used cars into a fine art of tech-driven commerce.

Who invests in German unicorns?

We’re talking a global guest list where the elites RSVP. Venture capital funds, private equity sharks, and sometimes even the bold European Investment Bank.

These backers come with deep pockets and an eye for a gemstone amid the pebbles.

What was the first German unicorn?

Ah, let’s waltz down memory lane. Zalando kicked open the doors, turning heads as it sashayed into the unicorn club back in 2014.

This stylish online retailer set the tone for what a German startup could aspire to.

How do German unicorns impact the economy?

They’re like turbo-boosters for the engine. Unicorns sling Germany onto the global stage, showcasing it as a fertile ground for innovation.

Jobs, investor interest, and a vibrant startup ecosystem — these unicorns aren’t just mythical; they’re economic catalysts.

What challenges do German unicorns face?

It’s not all rainbow roads and pots of gold. Finding the right talent, navigating regulatory jungles, and scaling operations are Herculean tasks.

Not to mention the pressure-cooker scenario when IPO doors knock. But hey, no one said taming a unicorn was easy.

Where in Germany are unicorns mostly found?

Berlin is the heart, the central hub, throbbing with high-growth startups and investors. It’s the Silicon Allee of Europe.

But don’t be fooled — talent and ideas are sprawling across the country, from Hamburg’s docks to Munich’s tech parks.

What’s the future outlook for German unicorns?

Buckle up; it’s looking like an Autobahn stretch ahead — full speed, no limits.

With new blood like CureVac leaping into the limelight and government policies fueling the fire, Germany’s unicorn landscape is set for a scorching ride into tomorrow’s horizon.

Conclusion

In the dance of digits and innovation, German unicorns have etched an indelible mark. They aren’t just companies; they’re testaments to a culture that champions boundary-pushing creativity and a rock-solid work ethic.

- Bask in the glow of Berlin’s tech scene, an electric nexus where these unicorns are nurtured.

- Tuck into the narratives of visionaries steering the ship at N26 or Zalando—pioneers who have dared to imagine and re-imagine.

- Savor the scent of change that wafts through the marketplaces with every successful venture capital funding round.

Delving into this landscape, you’ve trekked past the why’s and how’s. You’ve been acquainted with the challenges lining the meadow and the boundless opportunities that beckon. So, whether you’re inspired to be the next unicorn whisperer or simply intrigued by the prowess of Germany’s finest, remember that when innovation canters through the heart of Europe, it does so with unbridled force. Here’s to chasing the horizon—where business is bold, and unicorns are born.

If you enjoyed reading this article about German unicorns, you should check these also: