Navigating a sea teeming with eager investors, the savvy set their sights on treasure-laden vessels yet to dock at the public market’s bustling piers.

That’s right—I’m talking about the allure of buying pre-IPO shares—a financial maneuver that feels a bit like an insider’s secret handshake.

It’s access to the ground floor, where stakes are claimed before a company’s grand debut on the stock exchange stage.

In this deep dive, we’re stripping away the mystique. Venture capital? Angel investing? Consider these terms demystified.

From the regulatory rigmarole to the financial forecasting, you’ll emerge conversant and confident in the elusive art of early-stage investing.

By the final punctuation mark, you’ll grasp the choreography of equity crowdfunding platforms, comprehend the intricacies of private equity, and discern the rhythm of the illiquid assets dance.

This is the know-how that turns the heads of seasoned financial planners and piques the interest of the most circumspect accredited investors. It’s not just an article—it’s your new playbook.

Get ready to peer behind the curtain at the pre-IPO spectacle, where risk and reward waltz in close quarters. Here we go.

Venture Capitalists, Angel Investors, and the Pre-IPO Playground

Joining the VIP Club: How to Buy Pre-IPO Shares

So, you want to hang with the big players like venture capitalists and angel investors? Yeah, that’s where you get to dive into the pool of buying pre-IPO shares.

Picture this: You spot a cool startup, you throw in some cash to help ’em out, and then BAM! You’re on the inside, riding the wave to what could be a big payday when they go public.

These venture capitalist folks? They’re like the pro surfers of investing, waiting for the perfect wave (or time) to launch an IPO. They’re all about that exit strategy, making the most bucks possible.

And what about those angel investors? They can push the company to jump into the public world sooner, giving a little more life to their own portfolios. But, heads up, there might be a price tag on having these early-stage investors in the mix.

Why Bother with Pre-IPO Shares? They’re Like the VIP Passes of Investing

Striking Gold: The Potential Big Bucks

Okay, here’s the juicy part. Pre-IPO shares can make you feel like you’ve won the lottery. You pick the right company at the right moment, and you might just hit the jackpot.

It’s why a bunch of the seasoned pros are all about buying pre-IPO shares. Think about it – it’s like planting a tiny seed and watching it grow into a money tree.

Be Part of the Cool Kids: Early Access to Hot Stuff

People don’t just jump into buying pre-IPO shares for the thrills. Nope, they want a big piece of the pie, and maybe even a say in what flavor the pie is.

If you want a voice in the big decisions, you gotta jump in before the company gets all public and fancy.

Spread Those Eggs: Diversifying Your Basket

Wanna make your money work in different ways? Pre-IPO shares might be the answer. You can grab different stocks and watch your money grow in different ways.

It’s like a magic trick for your wallet, all thanks to the low market value of pre-IPO shares.

But Wait, It’s Not All Rainbows and Butterflies

Stuck in the Mud: Illiquidity and Lock-up

Imagine buying something and realizing you can’t resell it easily. That’s what you might face with buying pre-IPO shares.

You’re pretty much stuck, waiting for the company to go public.

And don’t even get me started on lockup periods, where you can’t sell the shares for a while. Know the rules of the game before you play!

Peering Through the Fog: Information? What Information?

Here’s the tricky part about pre-IPO investing. It’s like trying to navigate a maze blindfolded.

Public companies spill the beans about their finances, but private companies? Nah, they can keep it all under wraps.

So, if you’re thinking of buying pre-IPO shares, you might not have all the details you need.

The Cloudy World of Valuations in Pre-IPO Shares

It’s Not Always Clear Skies Ahead

So you’re thinking of buying pre-IPO shares? Awesome! But buckle up, because there might be some turbulence ahead. Ever try to pin a tail on a donkey while blindfolded? Well, figuring out if a private company is going public soon can feel a bit like that.

You want to sell those unlisted shares? Might not be a walk in the park either. And here’s the real kicker – no one’s handing out guarantees that those IPO share prices will be higher than what you paid pre-IPO. It’s a rollercoaster, and you’re in the front seat!

How to Play Detective with Pre-IPO Companies

Meet the Bosses: Evaluating the Big Wigs

So you want to know who’s steering the ship?

Look no further than the management team. Dig into what they’ve been up to before, how they’ve rocked their current market, and if they’ve ever taken a company public.

You want a squad that’s been in the game and knows how to score!

The Blueprint: Understanding What They Do

Alright, let’s break it down. You gotta get the scoop on the company’s business model and the playground they’re playing in.

It’s like getting a map of the maze before you dive in. Are they all about investing wide and waiting for the jackpot? If so, you might be onto something!

The Rumble in the Jungle: Sizing Up the Competition

No one’s playing alone out there. You gotta see how big the pie is and how much your chosen company can grab.

Pre-IPO shares often mean you’re betting on the new kid in town, doing something different. So, you gotta check: Are they convincing people to hop on their train?

Money Talks: A Peek at the Wallet

Let’s talk dollars and cents. Dive into the company’s cash flow – the revenue, the spending, the gains.

It’s like checking the engine before you buy the car. You need to see if that thing can really run!

Navigating the Legal Jungle

The VIP Pass: Accredited Investor Stuff

Hold up, there’s been a shift in the wind. In the last decade or so, buying pre-IPO shares has seen more and more of these accredited investors jumping in. It’s like a club, and not everyone gets in.

Under the big ol’ federal law umbrella, only certain players can toss money into some of these games.

They’ve got to be the ones who know their stuff and can handle the ups and downs without needing a safety net. It’s like riding a bike without training wheels – gotta know what you’re doing!

The Rules of the Game: Buying Pre-IPO Shares and SEC Stuff

The Big Rule Book: U.S. Securities and Exchange Commission

So, you want to get your hands on some pre-IPO shares? Nice, but wait, there are rules, like a board game but way more serious. It’s all about how the company’s gonna spend the money they get from going public.

They have to spell it all out. What’s the money for? How much will go where? When’s it gonna be spent?

It’s not just Uncle Sam’s rules either. There are exchange rules and listing stuff, corporate guidelines, and even how they figure out fees. Sounds like a party, huh?

Watch Your Step: It’s a Scam Jungle Out There

Ever hear of something too good to be true? Well, buying those unregistered shares in a private company might just be that.

Sometimes it’s risky, and sometimes it’s a straight-up scam. Like buying a car that turns out to be a cardboard cutout. Ouch.

How to Play it Smart with Pre-IPO Shares

Don’t Put Your Eggs in One Basket: Spread ‘Em Out!

You’ve heard it before, right? “Don’t put all your eggs in one basket.” Well, that’s diversification for you. It’s like not betting everything on one horse.

You’re spreading your cash across different places to play it safer. If one falls, you’re not totally out of the game.

Get a Guide: Find Someone Who Knows the Way

Investing in these pre-IPO or unlisted shares can feel like walking through a maze blindfolded. Finding someone who’s been there, done that, can help.

Think of it as getting a guide for a tricky hiking trail. They’ll steer you right.

Know Your Limits and Play the Long Game

Okay, let’s talk about you. How much can you handle losing without freaking out? That’s your risk tolerance. If you’ve got cash to spare, maybe you’ll play a bit wilder.

But remember, you never really know when the company will go public, or if they even will. It’s like waiting for a bus that might never come.

Sometimes these IPOs are stopped cold, pushed back, or scrapped altogether. Surprise!

You gotta figure out what you can handle and see if any of the pre-IPO deals fit your style.

It’s not everyone’s dance, and that’s okay. Think of your long game, too. Got time? Maybe you can play a little more daring.

Jumping into Pre-IPO Shares: A Guide to Platforms, Choices, and Successes

You ever think about buying pre-IPO shares? You know, grabbing a piece of a company before it goes public? Sounds cool, right?

Here’s a bit about what’s out there to help you with that.

Platforms Where You Can Dive into Pre-IPO Investing

Okay, so there are places, like brokerages and special institutions, that live for this kind of thing. They either help people buy and sell pre-IPO shares, or they have some themselves that they want to unload.

These folks are all about making the pre-IPO thing easier, and some big names are into this game. Think EquityZen, Raison, and Forge Global, among others.

Angels and Tech Startups: A Match Made in Heaven

If you’re looking at tech startup companies and thinking, “Hey, I want a piece of that pie!” but you’re a bit spooked by the idea of spending a ton of money, then maybe try the angel investing route.

Imagine joining a club with others like you, pooling your money, and buying those unlisted shares. These angels are usually pretty loaded and know the business game. They invest in startups that need money quick, in return for a slice of the ownership or some debt they can convert later.

Crowdfunding: Backing Tomorrow’s Big Thing Today

You know those crowdfunding sites where inventors and entrepreneurs sell their big ideas? Well, you can actually invest in a startup that way.

You spot something you think will grow and just dive in. It’s like betting on a horse you really believe in, except it’s a company.

Secondary Markets: The Backdoor into Big Names

So, say you want to invest in something like SpaceX or Airbnb. You could go to a place like EquityZen or MicroVentures. These secondary markets let big-time investors or employees of cool private companies sell their shares.

These platforms are more for the elite crowd, and people usually go there to grab shares from those looking to make an exit. It’s like a secret club where you get to buy into companies you love.

Big Wins in the Pre-IPO Game

Let’s talk about some real success stories with the pre-IPO thing. Gives you a taste of what’s possible.

Facebook’s Big Adventure

Facebook has been handing out shares like candy to the elite investor crowd. Big names like Peter Thiel and Reid Hoffman got in on the action early. The company went all out, raising billions, all aimed at boosting that IPO.

Uber: A Money-Making Machine

Uber, the ride-sharing giant, has pulled in crazy amounts of funding, making it one of the big players in the pre-IPO game.

There are some heavy hitters involved here, owning a chunk of the pre-IPO shares, like SoftBank and Alphabet.

Airbnb’s Sky-High Ascent

Airbnb’s shares started at $68 pre-IPO and went through the roof. They were trading at $149 when they went public, way above what people thought at first.

Their pre-IPO valuation? A mind-blowing $47 billion.

Hold Up! The Bumpy Road of Pre-IPO Investments

We’ve all heard the hype about buying pre-IPO shares, right?

But sometimes, this path isn’t all sunshine and rainbows. Here’s a look into some stories where the dream crashed hard.

You’ll want to pay attention to this if you’re thinking of diving into this investment world.

Theranos: From Billion-Dollar Dream to Nightmare

So, here was Theranos, this big-deal biotech startup. The founder, Elizabeth Holmes, was like the superstar of the business world. The youngest female billionaire in the US? You bet!

But fast forward a bit, and boom! Massive fraud charges and bankruptcy.

What was once seen as the next big thing turned out to be a total scam. Yes, there were red flags, but the investors, customers, and partners were all fooled. A grim tale to remember.

WeWork: A Fall from Grace

WeWork’s story is like a rollercoaster. Imagine being valued at $47 billion and then, in what seemed like a blink of an eye, tumbling down to less than $8 billion.

That’s what happened when they had to cancel their IPO.

A big messy fight between shareholders and the founder-CEO, a bailout, and a company that went from hero to zero.

If you’re into buying pre-IPO shares, this is the sort of story that might make you think twice.

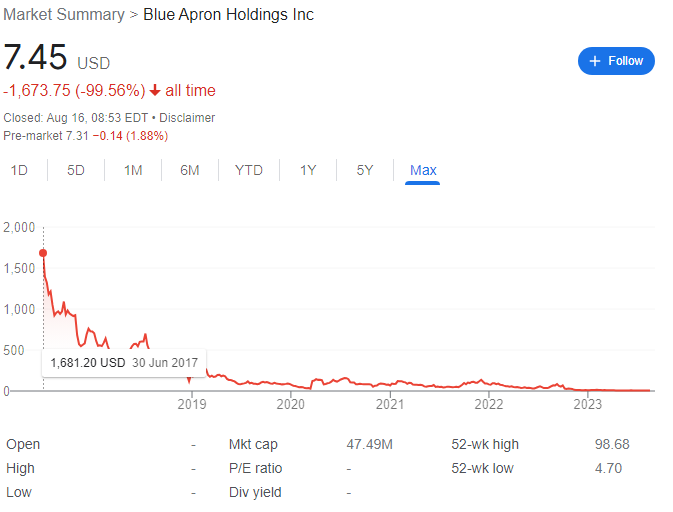

Blue Apron: A Recipe for Trouble

Blue Apron, they were all set to win in the market. And then, like a twist in a movie, Amazon announced they were buying Whole Foods for a huge sum.

Suddenly, Blue Apron’s IPO plan looked weak. They had to drop the IPO price, and things just went downhill. Even after people were ordering food like crazy during the pandemic, the company’s still struggling to make a profit.

It’s like watching a sports star who’s about to win and then stumbles right before the finish line.

What’s the Takeaway?

Buying pre-IPO shares is an exciting game. But it’s got its risks, and these stories are proof. Whether it’s the trickery of Theranos, the rapid decline of WeWork, or the tough luck of Blue Apron, they all show that the pre-IPO world isn’t just about easy wins.

FAQ On Buying Pre-IPO Shares

How does one become eligible to buy pre-IPO shares?

Eligibility’s a game of who-knows-who and what’s-in-your-wallet. To snag these shares, you’re often looking at being an accredited investor. That means meeting specific income or net worth criteria set by SEC regulations.

It’s not just a matter of cash – connections count. Knowing the right venture capital players or private equity firms can be your golden ticket.

What are the risks associated with pre-IPO investments?

Heads up, high rewards come with high risks. Pre-IPO shares are the daredevils of the investment world, bound to no public scrutiny or market liquidation convenience.

If the startup stumbles, your investment might take a nosedive, lock-up periods could stall your exit strategies, and let’s not forget about the potential regulatory changes that can shake things up.

Can pre-IPO shares be sold or are they locked up?

Talking about lock-up periods, think of ’em like a holding cell for your shares. Post-IPO, you’re often looking at a lock-up agreement that stops you from selling shares for a set period.

However, sometimes a secondary market can offer a backdoor out – but it’s no walk in the park to find buyers for private shares.

How is the valuation of pre-IPO shares determined?

Valuation’s a complex tango of forecasting, historical data, and some educated guesswork. Financial experts will dissect everything: venture capital funding rounds, the financial health of the company, market demand, and projected growth.

Yet, it’s partly intuitive – there’s a splash of ‘the right moment’ and the allure of growth company potential.

What’s the difference between options and pre-IPO shares?

Clearing the fog here: options are like IOUs for stocks at a fixed price, while pre-IPO shares? You’re buying the actual stake, outright.

Options let you wager on future stock performance, but those pre-IPO shares? They’re already a weight in your portfolio, with all the perks and risks they carry.

How do I conduct due diligence before buying pre-IPO shares?

Roll up your sleeves; it’s detective time. Scour over financial statements, market analysis, management team records—leave no stone unturned.

Due diligence means verifying every claim, undressing the hype to its bare facts. Get cozy with the SEC filings if available, and consult with financial advisors who’ve danced this number before.

Are pre-IPO shares accessible to non-accredited investors?

Once upon a time, ‘no’ was the flat answer. But now, equity crowdfunding platforms have changed the tune. They’ve opened doors for the everyman to invest in startups, breaking down barriers that once favored the investment elite.

Still, tread carefully, since the playing field’s more Wild West than Wall Street for non-accredited investors.

What happens to pre-IPO shares after the company goes public?

It’s showtime when private goes public. Pre-IPO shares transition to the stock market, and the shackles of illiquidity break away.

Post-IPO, shares can float to the rhythms of market demand. But remember, if lock-up periods apply, you can’t turn those shares into cash until the clock ticks down.

How does investing in pre-IPO shares differ from the regular stock market?

It’s like comparing wilderness to a mapped city. Pre-IPO means less info, more guesswork, and more patience needed.

With public stocks, the lay of the land is clear: tickers flicker with real-time prices, and sell buttons await your twitchy finger. Pre-IPO shares play the long game; you’re in it for potential growth, not instant liquidity.

Can you make changes to your investment once you’ve bought pre-IPO shares?

Flexibility isn’t its strong suit. Once in, you’re pretty much strapped into the ride. Amending the deal? Tough luck.

You’ve committed to the investment terms, barring some extraordinary circumstances or private negotiations in the secondary markets—and even then, it’s a needle-in-a-haystack chance. Think “marriage” more than “casual date.”

Conclusion

Navigating the tempestuous landscape of buying pre-IPO shares isn’t for the faint-hearted. But equipped with knowledge—on liquidity riptides and regulation reefs—you’re better prepared to sail these choppy financial waters. We’ve unfurled the intricacies of early access, from accredited investor credentials to the excitement of growth company stakes, setting you ahead in the investment regatta.

In wrapping up:

- Remember, the valuation of these coveted shares is less science, more art.

- Due diligence? More than a buzzword—it’s your financial compass.

- The allure? Not just potential gains but a stake in innovation’s vanguard.

- The caution? Beware the lock-up period’s siren song.

Pre-IPO investing is forging ahead, not just for Wall Street wizards but also for those venturing from Main Street seeking equity crowdfunding adventures. With this wealth of insights, you are no longer a bystander but an informed participant in the pre-IPO theater, ready for the curtain raiser. The stage is set and your script awaits.