Imagine a world where financial barriers crumble at the tap of a screen.

Fintech startups are at the forefront, pioneering a revolution that reshapes how we interact with money.

They are the catalysts, unleashing an era where financial inclusion and innovative payment solutions are not just buzzwords but tangible realities transforming our day-to-day life.

In this digital odyssey, you’ll unlock the secrets behind these disruptors.

I’ll navigate you through the maze of venture capital funding, the heartbeat of neobanks, and the cutting-edge AI driving personalized finance management.

By the article’s end, expect to wield the knowledge that powers these fintech mavericks—whether it’s the scrutiny of regulatory bodies or the symbiosis with global remittance services.

We’ll delve into the threads weaving the vibrant tapestry of this industry—each one a story of ambition and digital alchemy.

Prepare to embark on a journey that not only demystifies fintech but positions you at the vanguard of its unfolding narrative.

Fintech Startups

| Fintech Startups | Services Offered | Target Users | Geographical Availability | Notable Features |

|---|---|---|---|---|

| Elwood Technologies | Crypto trading technology | Institutional investors | International | Provides market data, order routing, and trade execution |

| Rapyd | Payment solutions | Individuals, Businesses | Worldwide | Offers a fintech-as-a-service platform supporting various payment methods |

| Nubank | Digital banking | Consumers | Mainly Latin America | No-fee credit card and transparent services |

| ThinkMarkets | Financial brokerage services | Traders, Investors | International | Forex & CFDs trading, with advanced technology platforms |

| Hydrogen | API platform for fintech products | Developers, Businesses | Worldwide | Enables building of financial applications with modular APIs |

| Passport | Mobile-first parking and transit payments | End users, Municipalities | North America | Facilitates mobile payments for parking and transit services |

| Tonik Bank | Digital banking | Consumers | Philippines | Offers savings and loan products through a digital platform |

| Sunbit | Buy now, pay later services | Consumers | United States | Provides financing for everyday needs with flexible payment options |

| PayMongo | Online payment processing | SMEs, Entrepreneurs | Philippines | Simplifies payment acceptance for businesses in the Philippines |

| Payoneer | Cross-border payments, working capital | SMBs, Freelancers | Worldwide | Focuses on facilitating global business payments |

| Z1 Conta | Digital banking for teenagers | Teenagers, Parents | Brazil | Provides digital accounts with spending control for teenagers |

| Method Financial | Payment and debt repayment infrastructure | Businesses | United States | API for adding debt repayment to any application |

| CoinList | Crypto asset trading | Crypto investors, Traders | International | Helps users access new tokens and trade cryptocurrency |

| iDonate | Fundraising platform | Nonprofits | Primarily United States | Facilitate donations through comprehensive digital tools |

| Qonto | Online banking for SMEs and freelancers | SMEs, Freelancers | Europe | Easy business accounting and financial management |

Elwood Technologies

Elwood Technologies is carving out a niche in the world of blockchain and cryptocurrencies. They create cutting-edge trading infrastructure tailored for digital assets. Their platform is a hit with institutions needing robust, enterprise-grade trading tools.

What they stand out for:

Elwood’s got this way of merging institutional finance savvy with tech-forward thinking. Picture Wall Street meets Silicon Valley but all wrapped up in the crypto craze. They’re on point for anyone riding the digital wave and looking for a solid, heavy-duty trading cockpit.

Rapyd

Poking around the digital payment space, you’ll stumble upon Rapyd. It’s no run-of-the-mill payment gateway—these folks have built a global payment network that’s like a Swiss Army knife for cash flow.

What they stand out for: Rapyd stands out for wrangling just about every payment method under the sun. Waving goodbye to borders, they ensure money zips around the world with finesse. If you’re a business wanting to go global without the payment hiccups, Rapyd’s your rock star.

Nubank

Oh boy, Nubank! They’re like the fresh-faced rebels of digital banking. You’ve got a bank that’s tossed out the dusty ledgers and gone full-throttle on mobile banking accessibility.

What they stand out for: Nubank gets a gold star for flipping traditional banking on its head. They’ve made friends with millions giving financial liberation with just a few taps. If the future was a bank, then Nubank’s designing the blueprint, making financial inclusion the real deal.

ThinkMarkets

Dive into ThinkMarkets, and you’ll see a fintech startup that’s all about seamless investing. They’re shaking up the trading scene with a platform that’s good for pros and newbies alike.

What they stand out for: ThinkMarkets brings the heat with tools that are both razor-sharp and user-friendly. You’ve got your robo-advising sidekick and a ton of financial data analytics to shape up your trading game. They’re not just any investment app; they’re your slick journey from trading training wheels to wheeling and dealing like a pro.

Passport

Hop on the Passport bandwagon if international e-commerce shipping has you biting nails. These folks have ironed out the kinks of cross-border logistics and duties with style.

What they stand out for: Passport is about transforming headaches into high-fives. Their focus? E-commerce businesses hungry for a slice of the global pie but dreading the shipping chaos. Passport practically rolls out the red carpet for your goods—smooth and hassle-free.

Tonik Bank

Tonik Bank is the embodiment of neobanks’ groundbreaking potential. These trailblazers are charging through Southeast Asia, ripping up the conventional banking playbook and going digital-only.

What they stand out for: Tonik Bank’s drawing in the crowd that’s been overlooked by the ol’ brick-and-mortars. With a mission for financial inclusion, they’re handing out accounts like candy—minus the queuing, paperwork, and the eye-glazing fine print.

Sunbit

If you’ve ever wished for some flexibility when the cash register rings up a hefty sum, Sunbit gets you. They’re dishing out bite-sized financing options on the fly—right when you need them.

What they stand out for: Sunbit is about spreading out the spend without the stress. Whether it’s a new set of tires or a dental visit, their point-of-sale loans are fast, friendly, and won’t break the bank. Credit snobs, step aside; Sunbit’s got a seat for everyone at the financial table.

PayMongo

Coming out of Manila, PayMongo slips into the fintech scene as the hot-shot wunderkind of payment processing. They’re smoothing out the cyber cobblestones for Philippine businesses dipping toes into online selling.

What they stand out for: PayMongo gives a high-five to the hustlers and dreamers turning the e-commerce wheel. Their platform is all about intuitive design—simplicity meets capability. Payment gateways, who? PayMongo’s redefining how money moves in the growing digital marketplace.

Payoneer

Payoneer is an old hand at helping businesses and freelancers get their due from across the globe. Think of them as a financial bridge builder—connecting bank accounts, marketplaces, and digital wallets into one sweet harmony.

What they stand out for: Payoneer took a look at the global gig economy and saw opportunity. They’re here for the movers and makers looking to cash in on their talents without borders bogging them down. With Payoneer, it’s like having a local bank account in just about any country.

Z1 Conta

Z1’s busting onto the scene with a bank account that’s not your grandpa’s piggy bank. Aimed at teens in Brazil, they’re schooling the next generation in managing moolah with smart, sleek banking tools.

What they stand out for: Z1 Conta’s in the spotlight for giving youngsters the captain’s hat of personal finance. No more allowance handouts in stale envelopes. They’re all about empowering the Snapchatting, TikToking generation with digital wallets and money sense that’s on point.

Method Financial

Method Financial is one of those fintech startups that’s not just following trends—they’re painting them. They’re offering an API-first approach to tackling the Everest of debt management and payments.

What they stand out for: With Method Financial, you’re not just getting an API; you’re getting a key to a treasure chest of modern debt payment solutions. They’re instinctively in tune with what businesses need to make tackling debt as easy as streaming your favorite tunes.

CoinList

Hustle over to CoinList if you’re looking for where crypto enthusiasts and savvy investors unite. It’s like a launchpad for the newest, shiniest digital coins before they shoot for the moon.

What they stand out for: CoinList has an eye for the next big crypto dazzler. They’ve curated a space where early adopters find their next digital treasure. ICOs? STOs? If it’s about to make waves in the cryptosphere, chances are you’ll find it making a splash on CoinList first.

iDonate

For the selfless souls running non-profits, iDonate is the groundbreaker in gifting simplicity. Donations come rolling through like a feel-good wave with their techy, touch-friendly giving platforms.

What they stand out for: iDonate isn’t just another payment system; it’s a love letter to the culture of generosity. They’ve made it their jam to help good causes reach hearts (and wallets), with frictionless digital donation tech.

Qonto

Qonto swings into the fintech circus with a sleek, clean banking experience made for European SMBs and startups. They’ve chucked out the fluff and kept the stuff that makes business banking swift and painless.

What they stand out for: Qonto gets a nod for putting the smarts in smart banking. With tools that make you say, “Why didn’t I think of that?” they’re like that reliable workmate who’s always got the sticky notes and pens you need.

Gumroad

Gumroad’s got the backs of creators and artists turning their passions into paychecks. Their platform is a cozy corner where selling ebooks, courses, and art feels less hustle and more heart.

What they stand out for: Gumroad is warming the benches for anyone with a story to sell. With an eye for design and simplicity, they’ve carved out a chill zone for transactions without the traditional e-commerce migraine.

TrueLayer

If the fintech ecosystem had a backstage crew, TrueLayer would be the lead guitar. These cats are syncing up banks and apps with their shiny API tech. A digital handshake that lets you peek at your financial deets across various apps.

What they stand out for:

Slick, secure, and smooth as butter—TrueLayer makes data sharing cool and comfy. For devs wanting to build the next killer fintech feature? TrueLayer’s holding the door wide open.

Klarna

Tell ya what, Klarna is flipping the script on shopping sprees. You grab your gear now, sprinkle the cash later, no fuss, no muss. It’s “buy now, pay later” with a cherry on top.

What they stand out for:

Klarna’s strutting ahead as the poster child for flexible payments. Shopping gets a high five for fun and chill, thanks to their smoooth-as-silk payment options.

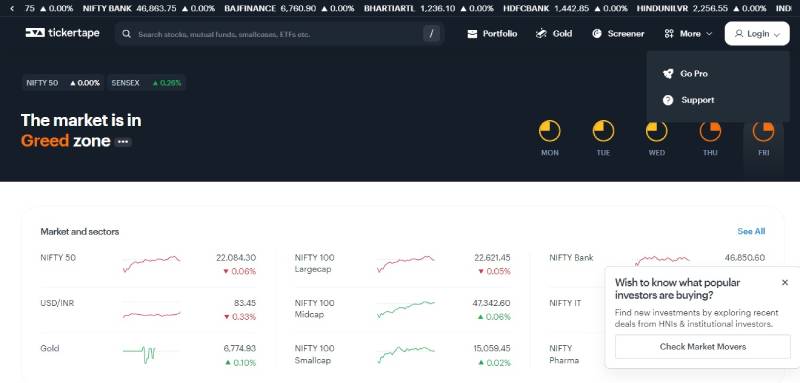

Tickertape

Diving into investment jargon could give anyone a headache, but Tickertape? They’re untangling the finance-speak with their investment tools. Think of it as your buddy who breaks down market mumbo jumbo over beers.

What they stand out for:

Tickertape shines bright for giving rookie investors the inside lane. They’re dishing out data on stocks and MFs that’s as easy to digest as your morning cereal.

GoodLeap

GoodLeap is all about lending a hand—or better yet, a whole stack of greenbacks—for eco-friendly upgrades. Giving your pad that solar glow has never been this breezy.

What they stand out for:

GoodLeap stands tall for firing up the planet-saving movement, one solar panel at a time. It’s feel-good financing that’s also easy on the wallet.

PayDo

When it comes to sprinting across the global financial playground, PayDo is lacing up your sneakers. A digital wallet mixed with swift international transfers keeps the cash flowing, no speed bumps.

What they stand out for:

PayDo’s ace is how they’re shifting the heavy-lifting of money movement to a feather-light dance. Freelancers and globe-trotters, say a big “ta-da” to your new money mate.

Wefox

Insurance, ugh, right? But roll with Wefox and bam, you’ve got insurance that suddenly feels like a Netflix binge. Personal, digital, customizable—insurance just got its makeover.

What they stand out for:

Stand-out is understating it for Wefox. They’ve flipped the script, making insurance something you’re actually keen to gab about. And it’s all snug in your pocket, one tap away.

Cash App

Cash App is injecting the fun into finance. Spin up a $Cashtag and send cash to your crew or snag a spontaneous burrito. Investing’s in there too, ’cause why not?

What they stand out for:

Here’s where Cash App’s nailing it—they’ve got millennials thinking, “Money’s cool.” It’s the Swiss Army knife of apps; transferring, spending, saving, all in one slick package.

Creditas

Creditas is causing a stir with its digital loans, wrapping you in a warm financial hug when the pockets are, well, lighter. They’re shushing the loan sharks with their softer, friendlier loan chairs.

What they stand out for:

Creditas rolls out a red carpet that’s all about unlocking that cash stuck in your stuff, be it your crib or your car. It’s like a money-making magic trick, except it’s real, and in your bank account.

Addi

Ah, Addi. Another “buy now, pay later” squad, but they’re turning it up in Latin America. Shopping gets a revamp—less of a wallet hit, more of a smooth glide.

What they stand out for:

Addi’s fam for breaking down barriers. Buying that must-have whatever just got redefined—it’s instant, but the bill? That’s a later problem.

Secfi

Secfi takes on the world of stock options like a pro. If it’s about getting the most from your equity without the tax migraine—Secfi’s cracking the code.

What they stand out for:

You’ve got Secfi as the map and compass for startup employees navigating the stock option forest. They’re the sage whiz, pointing the way to equity heaven.

Prodigy Finance

Prodigy Finance is your international studies’ godparent. Need a loan to hit the books abroad? They buzz in, superhero style—no collateral needed.

What they stand out for:

Truth? Prodigy Finance is breaking boundaries. Their loans have global students nodding “big yes” to their dream schools, minus the financial jitters.

BharatPe

BharatPe’s stirring the financial pot with its easy-peasy QR code payments in India. Shopkeepers cheer ’cause collecting dough just got as simple as a Bollywood dance move.

What they stand out for:

BharatPe’s big for lighting up the simplicity bulb. Payments between shop-goers and sellers? It’s a no-brainer now, thanks to their dude-I-so-got-this tools.

Trueaccord

Debt collection’s got a bit of a rep, but Trueaccord? They’re the good folks putting a friendlier face on the job. Less “pay up now”, more “let’s figure this out together.”

What they stand out for: By tossing out the scary playbook, Trueaccord is rewriting the rulebook. They’re about hand-in-hand strolls down debt-free lane, not the chase.

InfinitePay

Over in the land of payments, InfinitePay is the enfant terrible turning merchant servicing on its head—with rates sliced and diced, and cash flows that actually flow.

What they stand out for:

InfinitePay’s got business owners slow-clapping for the price cuts. It’s the fat bankroll at the end of the rainbow, flipping the bird at overly stuffed merchant fees.

Moneymax

Filipinos, meet your new smartypants resource: Moneymax. It takes all that tough finance stuff—insur’o, loans, credit—and makes it as family-friendly as a Sunday barbecue.

What they stand out for:

Moneymax scores big for nudging wise money decisions. It’s that knowledgeable cousin who’s got your back when money talk gets all serious.

Revolut

Revolut? Oh, they’re the poster child for shaking up the global money scene! A banking app with a bag full of tricks, from currency swapping to stock buying, all served with a side of AI budgeting.

What they stand out for:

Revolut’s raising the bar sky-high. They’ve turned their app into a lifestyle—a digital nomad’s dream co-pilot for flying financial freedom in your face.

Pixpay

Pixpay’s like the spellbook for finance-savvy teens in Europe. An app and card combo teaching youngsters the abracadabra of managing money before they’re even old enough to drive.

What they stand out for:

Pixpay’s scribbling its name as the cool mentor. They’re bridging the gap between allowance days and adulting with some smart finance tricks up their sleeve.

Chime

Chime is like that friend who always knows the best spots—the digital banking app that’s got your back with a fee-free zone and tools that make saving a breeze, not a chore.

What they stand out for:

Chime’s got the hype for being the cheerleader at the save-more, worry-less pep rally. They roll out neobanking with style and savings without the strings.

Pitchbook

Diving deep into the venture capital sea? Grab Pitchbook—it’s the trusty compass pointing investors to the freshest startups and deals that are ripe for the pickin’.

What they stand out for:

Pitchbook’s the sherpa guiding investors up the opportunity mountain. They’ve turned private market intel into a game of show-and-tell for pro dealmakers.

SellersFi

SellersFi talks shop for online sellers—like giving your online store its espresso shot with easy financing. Grow big, grow fast; SellersFi’s got your inventory and marketing covered.

What they stand out for:

Big kudos to SellersFi for breaking the grind barrier. They’re stoking the e-commerce fire and getting online shops through the growth spurt without the pinch.

BVNK

Say hi to BVNK—a platform leveling the playing field. Thanks to these champs, businesses are dealing with crypto and banking like they were born for it—smooth and suave.

What they stand out for:

BVNK’s got businesses doing the tango with crypto without missing a beat. Banking, meet blockchain; it’s a match made in finance heaven and BVNK’s officiating the wedding.

Remitly

Wanna send money home without losing half of it on the way? Remitly’s where it’s at. Tap in, send cash, and keep those international money transfers cushy and kind on fees.

What they stand out for:

Remitly’s earning props for zapping cash worldwide without the sting. They’re the trusty carrier pigeon in the digital age, without the snail pace.

Truist

Truist ain’t your typical bank—they’re mixing a century-worth of know-how with a sprinkle of tech magic. Banking’s old hat getting a top-to-bottom, tech-savvy revamp.

What they stand out for:

Truist is turning heads for pushing banks into tomorrow. They’re sliding the nifty neobank approach into every nook and cranny of their classic digs.

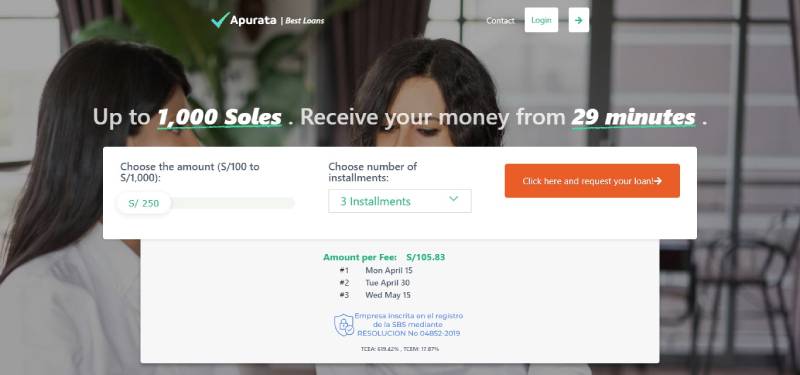

Apurata

Cracking the code for small, quick loans in Latin America is Apurata’s A-game. No paperwork, just a few taps and bam, you’re inching closer to that cash you need right now.

What they stand out for:

Props to Apurata for sprinting past loan dragons. They’ve lit a path for bites of credit with no strings—just quick cash without the panic.

Lunar

Lunar is beaming down as Scandinavia’s hotshot, all-mobile bank. They’ve got subscriptions that make finance feel less like a chore and more of a choose-your-own-adventure.

What they stand out for:

Lunar’s making some noise by ditching old banking’s worn-out shoes. It’s all about slick swipes, budgeting that’s not a bummer, and a friendly nudge when payday’s close.

Swipe

Swiping your way to crypto utopia? Not a pipe dream with Swipe. Cards, wallets, conversions—they’re unlocking the vault to turn digital coins into cold, hard groceries.

What they stand out for:

Swipe is buzzy about being easy. They’re taking crypto out for everyday spins—groceries, gas, you name it.

SoFi

SoFi’s your financial BFF—from lending a hand with loans to investing insights that don’t make your head spin. Nest eggs or debt wrangling, SoFi’s got the blueprint.

What they stand out for:

SoFi’s upping the ante by being a jack-of-all-trades. They’ve wrapped up personal finance into one polished app playbook.

Airwallex

Buzzword in the boardroom? Airwallex! They’re the co-pilot for businesses aiming for the stratosphere. Currency exchanges, international accounts—like a passport for your bucks to jet around the globe.

What they stand out for:

Airwallex means business when it comes to global finance. With them, it’s smooth sailing or flying high where payments and transfers cross borders like they don’t even exist.

Payactiv

For a workforce wanting a peek at payday before the calendar says so, Payactiv’s in play. They’re breaking the fortnightly paycheck tradition without the waiting game.

What they stand out for:

Payactiv’s grabbing attention by offering a breath of fresh air—cash flow on demand. They’re tossing out the old calendar and sprucing up paydays.

Paydock

Ever wish payments would behave? Cue Paydock. They help online retailers flex and flow with any kind of payment that customers might throw their way.

What they stand out for:

Paydock’s got it going with a payments orchestra—subtle, harmonious, and striking all the right chords when cash registers ring.

FAQ On Fintech Startups

What’s Fueling the Fintech Startup Boom?

Every day, more individuals crave control over their finances, empowering fintech startups.

They’re simplifying banking, bringing forth tools like mobile banking and payment solutions. Add venture capital funding and an itch for innovation; you witness this remarkable boom.

How Do Fintech Startups Disrupt Traditional Banking?

They’re dismantling the old guard! Fintechs leverage financial technology to offer user-friendly, efficient services.

By embracing digital wallets and API banking, these startups deliver what customers now demand: speed, convenience, and a touch of financial inclusion.

What is the Role of AI in Fintech?

Artificial Intelligence is the clever genie in the lamp. It’s turbocharging everything from personal finance management to fraud detection.

AI makes sense of vast data streams, offers personalized advice, and keeps your money safe, making fintech smarter every second.

How Important is Data Security for Fintech Startups?

Data security is the castle wall — absolutely non-negotiable. In a landscape dotted with digital threats, fintech startups invest heavily in robust data security measures.

They’re committed to guarding sensitive information, upholding PCI standards to foster trust and ensure longevity.

What Challenges Do Fintech Startups Face?

The path is strewn with obstacles like stringent financial regulations, competition from incumbents, and the critical need for continuous innovation.

Maintaining data security and consumer trust while navigating complex regulatory environments represents a significant hurdle for these digital daunters.

Can Fintech Startups Help in Financial Inclusion?

Absolutely, they’re championing financial inclusion. By crafting solutions accessible from smartphones, fintech startups are knocking down traditional barriers to entry, extending financial services to the underserved, often in remote corners of the globe.

Why are Payment Solutions a Big Deal for Fintech Startups?

It’s all about the flow of money. Fintech startups bring to the cashless society nifty payment solutions that are swift and hassle-free.

They’re redefining transactions, making them as easy as a swipe or tap, all while securing data every step of the way.

How Do Fintech Startups Attract Investors?

Innovation spells attraction. Investors flock to fintech startups that promise disruptive potential and possess a solid business plan aimed at untapped markets.

They hunt for teams that understand the nitty-gritty of financial regulations and have the gusto to navigate the complex fintech regulatory bodies.

What Impact are Blockchain and Cryptocurrency Having on Fintech?

They’re the mavericks of the financial frontier. With the allure of decentralized transaction systems and the promise of smart contracts, blockchain startups pique interest for security and transparency they offer.

Cryptocurrencies have opened a new landscape for payment solutions and investment opportunities within fintech.

What Does the Future Hold for Fintech Startups?

The future is an open book with bright, exciting chapters. Expect a surge in AI-led personal finance tools, deeper regtech integration, and a global push for financial inclusion.

Fintech startups will likely evolve to become even more intertwined with our daily transactions and lifestyle choices.

Conclusion

The terrain of finance is no longer what it once was; fintech startups are the vanguard of this brisk transformation. As we’ve journeyed through the intricacies of this burgeoning domain, the fusion of AI, blockchain, and a never-sleeping spirit of innovation has been clear.

From the raw potential of mobile banking to the unshakable might of data security, these pioneers are charting a course to tomorrow’s financial landscape. The road is rich with the agora of opportunity — payment solutions that seamlessly intersect with daily life, regtech ensuring steering through the maze of compliance, and the gallant march towards financial inclusion for all.

As eyes turn toward the horizon — bright with the promise of these startups — we find ourselves on the cusp of a fintech future. It’s not just transformative; it’s a world where every swipe, tap, and click frames the next chapter in the saga of financial technology. And so, fingers on tech’s pulse, we watch, we learn, we evolve.

If you liked this article about fintech startups, you should check out this article about digital health startups.

There are also similar articles discussing healthcare startups, environmental startups, DTC startups, and beauty startups.

And let’s not forget about articles on fashion startups, ecommerce startups, food startups, and fitness startups.