Picture this: Silicon Valley buzzing with electric ideas, entrepreneurs forging paths less traveled, and fever-pitched pitch events where dreams either soar or crash. That’s the riveting world of startups.

Plunge into the throbbing heart of innovation, and pretty soon, you’ll be seeking the next big thing. But here’s the rub — how do you sift through the hay to find those golden needles?

Diving headfirst into the startup landscape armed with just enthusiasm is like finding a needle in a haystack — it’s daunting, and you’ll need more than luck. This isn’t just about scouting; it’s strategic sleuthing.

In this tell-all, expect a roadmap to dig through startup directories, leverage networking for startups, and make a beeline to the freshest venture capital opportunities.

I’ll break down how you can use every tool at your disposal, from Crunchbase dives to hobnobbing at local business meetups.

By the end, spotting the high-growth startups won’t just be possible — it’ll be second nature.

Ready to leap into the world where business accelerators fuel tomorrow’s titans? Let’s find those startups.

The Guide to Discovering Unique Startups: How to Find Startup Companies That Stand Out

Spotting What’s Different: Product or Service Differentiation

Let’s say you walk into a store with a hundred kinds of cereal. How do you choose? You look for what stands out, what’s different.

That’s what product or service differentiation is all about. It’s like painting your product in bright colors so that it shines among the dull ones.

You need to pinpoint those zesty features that make your product dance out of the crowd.

This difference is like a beacon for those looking for how to find startup companies that offer something unique. It’s a hook that grabs attention.

Understanding the Playground: Market Size and Potential

Imagine building a sandcastle where there’s no sand. Sounds dumb, right? You need to know where the sand is, how much of it there is, and if it’s the good stuff.

That’s market size and potential for you. It’s like peering into the future of your business, seeing how big it can get. Investors want a sneak peek of this future too.

They want to know if your startup is surfing on a wave that’s growing. If you can show them a beach filled with golden sand, they’ll be more likely to join your sandcastle project.

The Secret Sauce: Unique Value Proposition (UVP)

Now, what’s the first thing you tell someone about your favorite burger joint? You talk about that sauce, the one that’s nowhere else.

Your startup needs that sauce. Your UVP is that flavor that makes customers come running.

It’s a promise, a wink saying, “Hey, you won’t get this anywhere else.” It’s a big neon sign on the road to how to find startup companies that are worth the buzz.

The Game Plan: Business Model and Revenue Streams

Think of your startup like a treasure map. The business model is the path, and the revenue streams are the spots where you’ve hidden gold.

Now, some startups have found paths that no one else has. They’ve stashed gold in places where no one is looking. Those are the hidden gems.

If you’re an investor, you want to peek at this map. You want to see if the gold is where no one else has looked. These paths, these gold stashes, tell you if this startup is sailing to Treasure Island or Lost Island.

Who’s Steering the Ship: Team Composition and Expertise

Imagine boarding a ship without a captain. Nervous? You bet! The same goes for investing in a startup. Who’s at the helm?

Are they pirates or adventurers? You’re not just investing in a ship; you’re investing in the crew.

A ship without a good captain and crew is likely to hit the rocks. You want to see if the captain’s got the maps, if the crew knows how to sail, and if they’ve been on adventures before.

This crew is your golden ticket on the quest for how to find startup companies that are more than a mirage in the desert.

The Trail to Startups: How to Find Startup Companies and What to Look For

Looking into the Money Bag: Funding History and Investors

So, you wanna know about the gold that’s backing a startup? You gotta dig deep into their funding history, like, really understanding where they’ve been getting their cash from.

It’s like snooping into their wallet. And yeah, you’ve got to know how fast they are burning that money too. It’s like trying to figure out how long that candle’s going to last.

Trust me, it matters. It tells you if they know how to handle money or if they’re just splashing it around.

The Rumble in the Jungle: Competition and Industry Trends

Okay, let’s talk about the wild west that is the market. The competitors, the trends, the noise. Think of it like a race. A startup’s got to be faster, smarter, and cooler than the rest.

If it’s doing something that puts it ahead of the gang, then you’ve got something interesting. That’s their edge, their weapon, their thing. It’s what might make them the last cowboy standing.

Your Treasure Map: Tools and Resources for How to Find Startup Companies

The Big Book of Secrets: Startup Databases and Directories

Ever wish for a magic book that has all the secrets? Well, in the startup world, it exists.

These startup databases are like the wizard’s guide to finding hidden gems. Names, details, funding information – it’s all there.

Private companies hiding in the shadows? These databases have a spotlight on them. Go on, take a look at Wellfound or Crunchbase.

The Secret Agents: Angel Investor Networks

Imagine having a team of secret agents on the hunt for the best places to put your gold. That’s what angel investor networks are.

The investors chill out, and the team goes on a quest for the golden startups. These angels don’t want the fame, just the fortune. It’s like a secret society of treasure hunters.

The Power of the Crowd: Crowdfunding Platforms

Crowdfunding is like a party where everyone chips in for a cool gift. Startups pitch their wild dreams, and folks who dig them pour in some coins.

It’s not just about money; it’s about love, belief, and that shared dream. It’s a platform where you can find the next big thing that hundreds of people believe in.

The Gathering Grounds: Industry-Specific Events and Conferences

Think of this as a carnival for startup enthusiasts. It’s where the wizards, the warriors, the dreamers, and the doers gather.

You can shake hands, exchange secret spells, and learn from the masters.

There’s wisdom in the air, tales of triumphs and failures. These events are like the pulse of the startup world. You can feel the heartbeat there.

The Digital Streets: Social Media and Online Communities

Want to know what’s cooking in the startup kitchen? Get on social media.

It’s like the town square, the gossip corners, the news hubs all rolled into one. You can follow the stars, the pioneers, the critics.

They all shout their thoughts there. Startups are born, grow, and sometimes die on social media. Keep an ear to the ground, and you’ll hear the buzz.

The Launch Pads: Startup Accelerators and Incubators

So, these are like the boot camps for startups. The nursery, the training ground, the launching pads. Accelerators and incubators are where ideas get wings.

They nurture, they feed, they push. If you want to spot a future rocket, keep an eye on these places. They’re the backstage of the startup world.

The Art of Discovery: How to Find Startup Companies and Make Wise Choices

The Treasure Hunt: Conducting Preliminary Research

So, you’re on the lookout for the next big thing in startups? Cool. Research is your treasure map. You need to know where to dig, what to dig for, and how to dig.

That means understanding what’s what in the world of startups.

Find something shiny and new? Awesome, but hold on. Don’t just grab it. You need to check it out. Look at the tech, the market, the folks behind it.

The Team Behind the Curtain: Assessing the Startup’s Team and Leadership

The team is where the magic happens. It’s like the band behind a great song.

You gotta know who’s playing the guitar and who’s on the drums. Look at their skills, their history, what they’ve done before.

They’re the ones who’ll take the startup to the stars or let it fall flat. So check them out, know their jam.

The Battlefield: Evaluating the Market and Competition

The market’s a wild place. It’s like a battlefield, and the startup is the new warrior. What’s the size of the field? Who are the other warriors? What’s the prize?

These are the things you need to know. It’s not just about being cool; it’s about being cool in the right place at the right time. Find out if the startup has got the moves to win.

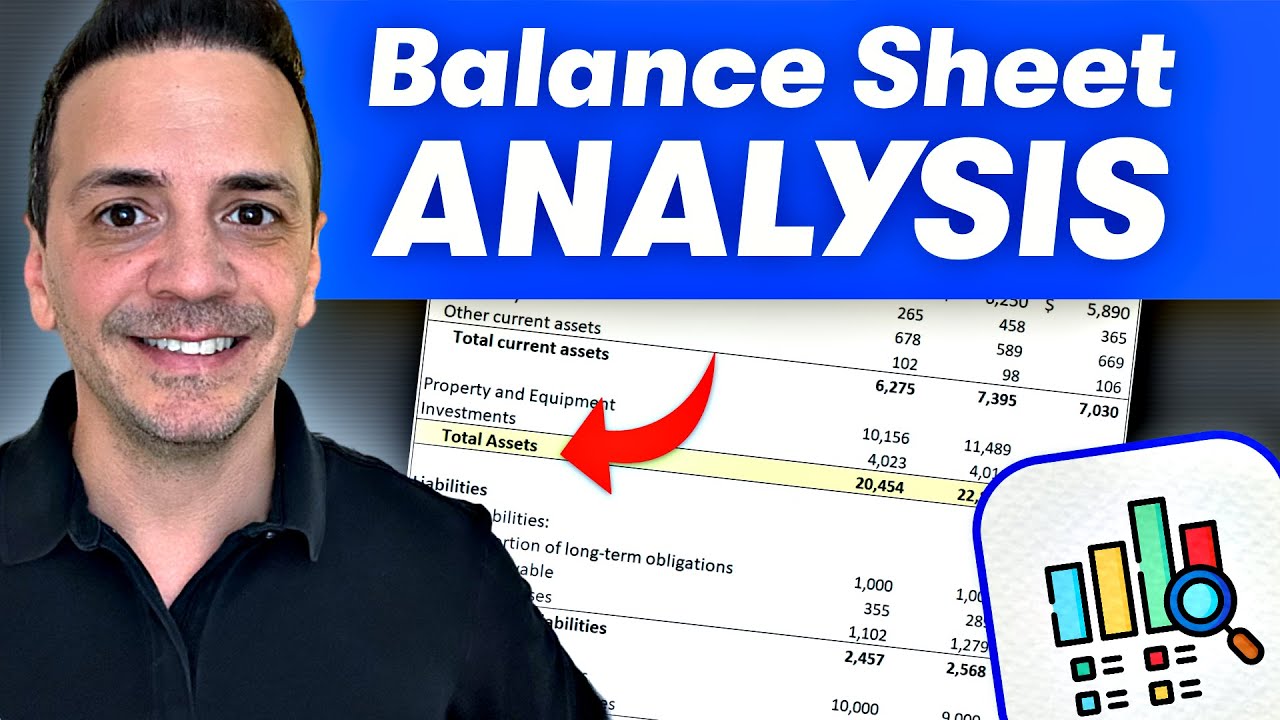

The Checkup: Analyzing Financial and Operational Metrics

Investing in startups is like taking a leap into the unknown. But you don’t have to jump blindfolded. Look at the numbers, the financials, the gears that make the machine run.

Make sure it’s solid, make sure it can roll. It’s like checking the engine before buying a car. You want a smooth ride, not a breakdown.

The Rule Book: Verifying Legal and Regulatory Compliance

Okay, so you don’t want to step into a mess. The startup needs to play by the rules. Check the laws, the paperwork, the whole legal dance.

It helps you see what’s ahead, what could go wrong. Think of it as looking for traps on a treasure hunt. You want the gold, not the pitfalls.

The Connection Game: Approaching and Engaging with Startup Companies

The Network Web: Building Relationships with Founders and Key Stakeholders

People matter. And in the world of startups, they matter a lot. Talk to the creators, the backers, the gurus. They have the stories, the insights, the warnings.

It’s like having friends in a new city. They’ll show you around, tell you where to go, what to see. Make friends; they make the journey richer.

The Pitch: Communicating Your Investment Thesis and Value Proposition

This is your game plan, your battle cry, your pitch. What’s your vibe? What are you looking for? It’s your story to the startup world. Make it clear, make it loud.

Let the startups know your groove, and they’ll find you. It’s like sending out a call to the dance floor. The right partners will come and join the dance.

The Dance with Startups: Negotiating and Nurturing

The Deal Dance: Negotiating Terms and Agreements

You’re ready to jump in. You’ve found the startup, and now you’ve got to make a deal.

That’s like dancing, too. You’ve got to know the steps, the moves, and the rhythm.

Here’s your dance card:

- Investment Term: That’s how long you’re in.

- Interest Rate: That’s your groove, your beat.

- Risk Profile: Are you dancing on a tightrope or a dance floor?

- Investment Horizon: When’s the last dance?

- Exit Strategy: How do you leave the floor when the party’s over?

It’s not just a dance; it’s a partnership. Research, ask around, get some advice. Make sure you’re dancing to your own tune.

The Harmony: Providing Ongoing Support and Guidance

Once you’re in, you’re part of the band. You’re not just watching from the crowd; you’re up on stage. Keep the rhythm going. Talk, share, listen, laugh. Keep the connection, keep the groove.

It’s a relationship, a jam session, a shared adventure. Start with the pitch, and keep the music playing long after the deal is done.

The Bumps in the Road: Risks and Challenges

So, you’ve got the stars in your eyes, dreaming of finding that perfect startup. But hold on a minute. Let’s talk about what can go wrong.

Is It Hot or Not: Market and Industry Risks

Maybe the company has a great idea, a killer product. But what if nobody wants it? What if some other company makes something cooler? Then what?

It could mess up the whole thing. It’s risky, right? You’ve got to figure out what people really want.

The Making It Happen Part: Execution Risks

Ideas are cool, and plans look great on paper. But making it all happen? That’s where it gets tough.

A lot of new companies hustle at the start, but then drop the ball. You need to know if they can really pull it off.

Rules and More Rules: Legal and Regulatory Risks

Starting up a business or putting your money in one? It’s a thrill. But it’s like a maze of laws and rules, from what the business is to how they handle data.

If you’re going to invest, you’ve got to know what can go wrong legally.

Cash Drama: Funding and Liquidity Risks

Cash is king, right? Well, with startups, cash can be like quicksand. There’s stuff like the risk of not having enough funding, the trouble with selling your shares, and things like exchange rates and interest.

Maybe you need the money back fast? Bad news. With startups, you might not get it. It’s all locked up, maybe no one wants to buy your shares, and there might be rules about selling.

FAQ On How To Find Startup Companies

Where do I even start looking for startup companies?

Starting the hunt for startups? Get cozy with platforms like Crunchbase and AngelList. They’re the treasure maps to the startup universe. Stay updated with the latest venture capital opportunities and you’ll catch wind of rising stars in no time.

Networking at industry trade shows or startup conferences like TechCrunch Disrupt also pays off big.

Can I find startups relevant to my industry specifically?

Absolutely. Specialization is key. Zone in on industry-specific databases and publications. If tech’s your beat, TechCrunch is your bible. For health, maybe HealthTech Magazine.

Y Combinator and similar incubators often showcase startups by sector. And never undervalue the gold mine of information local business meetups can be.

How important are networking events for finding startup companies?

Can’t stress this enough: crucial. Events like SXSW or local Chamber of Commerce meetings are hotbeds for startup mingling.

Face time with founders at these events can get you inside scoops, entry points into emerging companies, or even a foot in the door for investment.

What’s the role of social media in discovering new startups?

Social media is a giant, bustling cocktail party — great for eavesdropping on the latest startup buzz. LinkedIn and Twitter? Check them daily.

Founders and investors often spill the beans on exciting ventures in real time. Follow venture capitalists, angel investors, and use hashtags to your advantage.

Are there any tools or platforms that help in finding promising startup companies?

Yes, and they’re life-savers. Beyond Crunchbase or AngelList, tools like PitchBook, CB Insights, and even Google Alerts keep you keyed into the startup pulse.

Set notifications for startup directories updates or funding news, and you won’t miss a beat.

What indicators should I look for to identify a promising startup?

Look, it’s not just about a cool idea. Real talk? Solid teams, clear market fit, scalability potential, and of course, financial stability.

If a startup’s landing seed funding or has high-profile angel investors, that’s your signal they’ve got some serious fire power.

How do I gauge the potential success of a startup?

Big question. Begin with their business model. Is it making cash? Then, background check. Who’s steering the ship — any industry trade shows accolades or Forbes 30 Under 30 mentions? Last, market traction speaks volumes. Users growing? Sales climbing? There’s your answer.

Are there specific online communities where startups tend to gather?

Sure thing, and these hubs are buzzing! Websites like Startup Grind or forums on Reddit can lead to gold.

Plus, tapping into LinkedIn groups or following startup incubators pages equals instant inroads into these circles.

Can I find startup companies through academic or research institutions?

Absolutely. Universities are startups’ playgrounds. They birth cutting-edge ventures. Keep tabs on institutions with strong entrepreneurial slants or tech transfer offices.

Don’t overlook business plan competitions either. They’re springboards for the next big thing.

How do I stay updated with the latest startup companies coming up?

A mix of alertness and the right tools. Subscribe to newsletters from startup-focused news outlets. Tools like Feedly can help you manage this inflow.

Regularly attending pitch events and keeping your ear to the ground at local business meetups ensure you’re always in the know.

Conclusion

So, here we are at the end of our deep dive into how to find startup companies. Look, if you’re aiming to navigate this exhilarating but packed terrain, remember it’s about the right tools and a keen eye. You’re not just looking for startups; you’re looking for a match—a market fit that resonates with your portfolio or interests.

Consider this your checklist:

- Stalk Crunchbase.

- Network like you’re running for mayor—online, through social platforms, and at local business meetups.

- Pivot towards those pitch events—you’ll thank yourself later.

- And please, do me a favor, keep innovation on your radar—TechCrunch Disrupt, anyone?

It’s a wrap then. From the nooks of online platforms to the crannies of industry trade shows, your quest to uncover the hottest startups is set. Chase those ventures with vigor. Who knows? The next unicorn could be a conversation away.

If you liked this article about finding startup companies, you should check out this article about finding a cofounder for your startup.

There are also similar articles discussing how to bootstrap a startup, financial plan for your startup business, remote startup jobs, and questions to ask a startup before investing.

And let’s not forget about articles on landing pages for startups, starting a business but having no ideas, UK startup accelerators, and Australian incubators.